Search Results for "state-owned banks"

Chinese State-Owned Banks Start Exploring Digital Yuan Use-Cases for Buying Investment Funds & Insurance Products

Two Chinese state-owned banks have begun working to fund management and insurance companies to explore the use cases of digital yuan CBDC for purchasing investment funds and insurance products online.

China’s Major State-Run Commercial Banks Test CBDC Digital Wallet

China’s major state-run banks are testing out its central bank digital currency (CBDC) digital wallet application. The Chinese central bank, having said that its CBDC, also known as digital currency electronic payment (DCEP), is “almost ready,” is finally moving a step closer to its official launch nationwide.

China Construction Bank Announces Updates of Blockchain Platform After $50B Transacted

One of China’s four largest banks, China Construction Bank (CCB) has officially released the second version of its blockchain platform for trade finance, reaching 360 billion yuan ($50 billion) in cumulative transaction volume. CCB announced the release of “BCTrade 2.0,” focusing on digitizing trade and financial services between 54 domestic and overseas CCB branches and 40 external organizations. Reported by Xinhua news, these organizations include state-owned banks and foreign banks.

Open Banking & Banking Digital Transformation Congress will be held in August in Shanghai

Open Banking&Banking Digital Transformation Congress 2020 will be held on September 24-25 in Shanghai with a focus on digital transformation and open ecosystem construction of large state-owned banks, joint-stock banks, urban commercial bank, and foreign bank, etc. The congress will mainly discuss how iABCD empower retail, micro and corporate finance from perspectives of policy transmission, ecological construction, cultural innovation, business model innovation, product innovation, risk management, marketing, and the user experience, etc.

Banks Are Increasingly Starting to Offer Cryptocurrency Services in 2020

Banks have increased their interest in cryptocurrencies. Many of them have decided to join the cryptocurrency market, either by offering investments in cryptocurrency or by exploiting the capabilities of blockchain technology, which is already used in various areas with financial services.

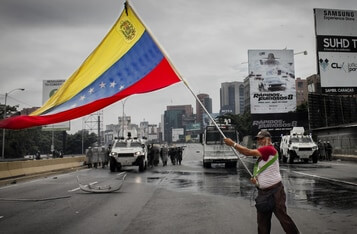

Chainalysis: Venezuela’s State-Owned Crypto Exchange Possibly Used by Maduro Regime to Launder Funds

Blockchain analysis company Chainalysis wanted to find out whether the claims of whether Petro aiding Venezuelans are true.

Chinese Banks Clarify on Crypto Account Freezing Despite Alipay’s Crypto Ban Last Year

China’s banks were rumored to be freezing client accounts that have a history associated with the buying and selling of cryptocurrencies. However, according to a recent report, Chinese banks have clarified that this is not the case, and they are not shutting down any legal fiat to crypto accounts.

Canada, Netherlands, Ukraine Central Banks Say Blockchain Not Necessary for CBDC

In a conference hosted by National Bank of Ukraine, some central banks recently suggested that blockchain is unnecessary for digital fiat currency

China's Central Bank Digital Currency DCEP: What We Know So Far

China has been charging full speed with its digital currency development plans in response to Facebook’s Libra. China’s state-owned bank, the People’s Bank of China (PBoC) has been reportedly developing their own digital currency aimed to replace cash in circulation and was said to be ready in the coming months.

Government-Owned Swiss Bank to Provide Custodial Services for Cryptocurrencies

With the readiness of government-backed Swiss bank, bank Basler Kantonalbank (BKB) to offer crypto custodial services, the financial service sector is an inch closer to driving mainstream adoption of blockchain technology

China’s Central Bank Partners with Commercial Banks and Telecom Giants to Test Digital Currency in Two Major Cities

New developments of China’s central bank geared towards testing its digital currency electronic payment (DCEP) in the cities of Shenzhen and Suzhou. The People’s Bank of China, the country’s central bank is on track to become the first central bank on the globe to issue a national digital currency.

Malaysian Crypto Miners Caught Stealing $59,700 of Electricity from State on Monthly Basis

Malaysian police recently arrested five cryptocurrency mining operators that were caught stealing electricity from a state-owned power company, Sarawak Energy Berhad (SEB).